Congress establishes the Internal Revenue Service (IRS): 1913

IRS Headquarters, Washington, DC

In 1913, Congress passed the 16th Amendment, creating what is today known as the Internal Revenue Service (IRS).

Before then, taxes looked very different than they do today.

Between the Declaration of Independence in 1776 and the start of the Civil War in 1861, there was no national income tax. Revenue came mainly from excise taxes (like on tobacco) and tariffs (like those on enslaved people “imported” into the country).

Excise taxes, like those on tobacco and alcohol, made up a large portion of government revenue

On the state level, nothing contributed more to government revenues than slave taxes, especially in the South.

Percentage of state tax revenues from slavery

Percentage of state tax revenues from slavery

During that time, slave taxes brought in so much revenue that small farmers paid almost no direct taxes at all. It was a progressive tax system but it was also a tax system based on the exploitation of stolen labor on stolen land.

At the start of the Civil War in 1861, the US government needed to raise more revenue. So, the Revenue Act of 1861 was passed, creating the nation’s first income tax. Incomes over $800 (~$28,700 today) were taxed at 3%.

In the modern era, taxes changed significantly.

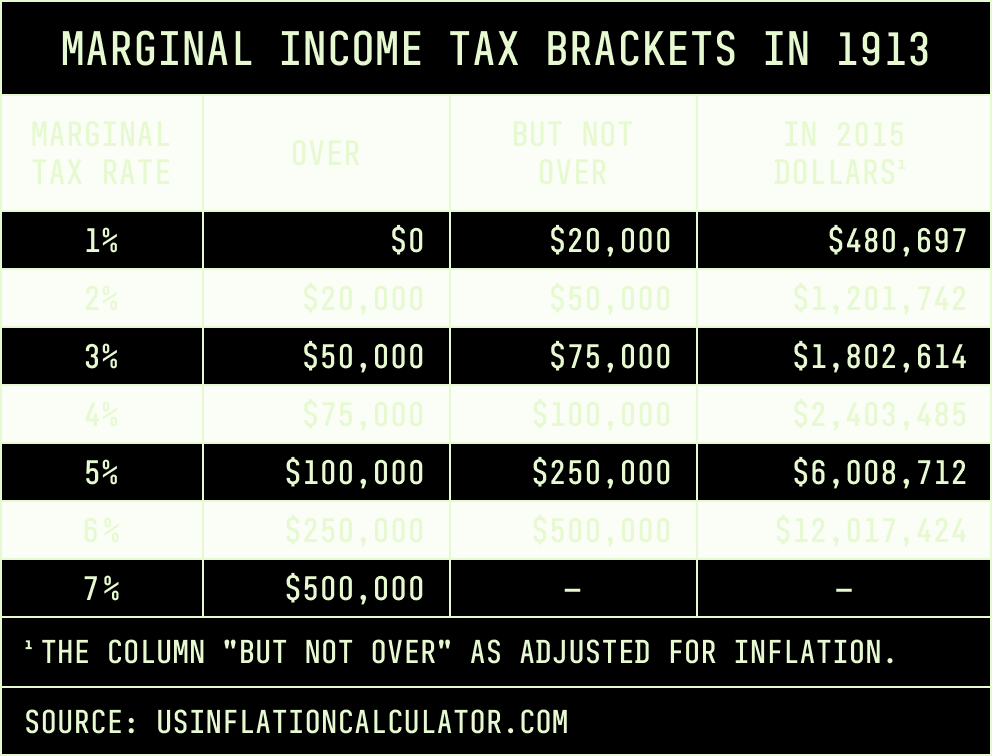

The tax structure created in 1913 was initially a progressive one and mostly taxed the wealthy. Less than 1% of the population paid taxes in 1913. The highest marginal tax rate at the time was a mere 7%. The marginal tax rate only applies to the top portion of someone’s income, so even people with the very highest incomes didn’t pay 7% on all of their earnings.

Marginal Income Tax Brackets in 1913.

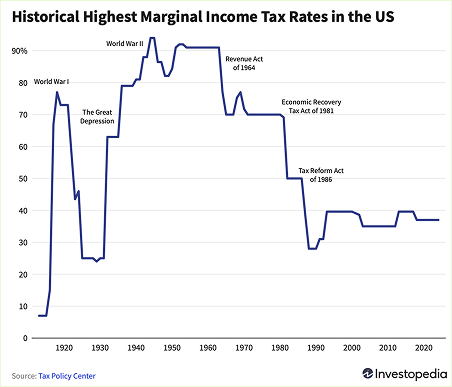

By 1918, the marginal tax rate was 77%. During the final years of the next World War, 1944 and 1945, the top marginal tax rate was 94%.

That didn’t last long.

Highest Marginal Income Tax Rate in the U.S. over the past 100 years

The taxes paid by the wealthy have plummeted over time.

Taxes continue to plummet for the wealthy, while those with greater need see no relief

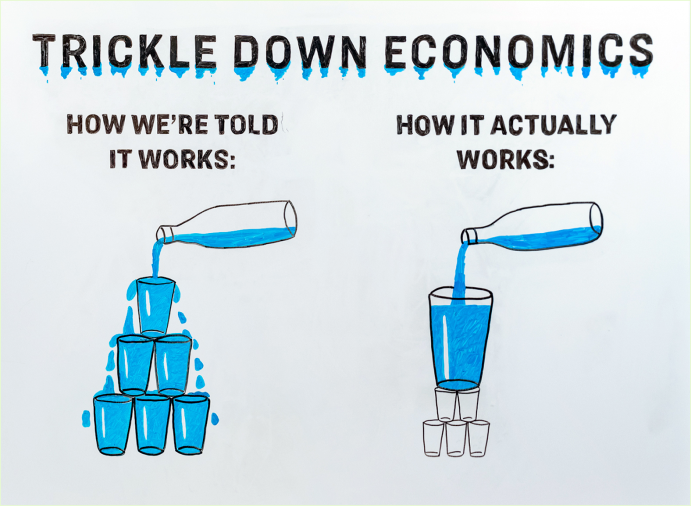

Lowering the tax responsibility for those with the most expendable income has consequences for everyone.

When taxes decrease, so do revenues, leaving less money to fund essential services.

Unlike the federal government, states are required to have balanced budgets. This means states often cut funds for cities and counties or raise revenue by adopting regressive taxes like fines and fees. People who are Black, Indigenous, and of color are the most disadvantaged by those decisions.

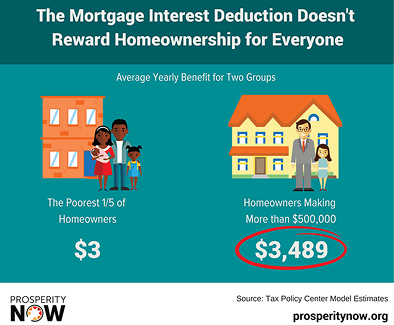

Another inequity in the federal tax structure is the mortgage interest deduction. White households receive over 75% of that tax benefit.

Inequity is built into the tax structure

The Tax Cuts and Jobs Act of 2017 was the most significant tax legislation passed in the last 30 years. While it increased the child tax credit, the overwhelming majority of the law benefited the wealthy. It cut the corporate tax rate from 35 to 21%,

increased the estate tax exemption making it easier for the wealthy to pass on more money to their descendants untaxed,

and cut the top marginal tax rate from 39.6 to 37%.

The TCJA didn’t lead to more jobs, fairer taxes, or bigger paychecks

Overall, billionaires saw their wealth grow, while working people gained almost nothing from the bill.

Elon Musk, estimated net worth of $356.7B, bought Twitter for $44B.

Jeff Bezos, estimated net worth $221B, bought a $500M super yacht

Its extension is being debated in Congress in 2025.

There are ways to right-size our tax system, though:

Trickle down economics does not work

- Push to reverse, not renew the TCJA.

- Stop rewarding wealth over work.

- Reform policies so that the wealthy and corporations pay their fair share.

- Get rid of regressive taxes which put an outsized burden on the poor and middle class.