Report on “Pinklining” Reveals How Wall Street Targets Women for Toxic Loans: 2016

Even though women make higher student loan payments than men, it takes them an average of two years longer to pay off those debts. [#48]

Wall Street has long taken advantage of women, especially women of color, historically having lower incomes and less wealth.

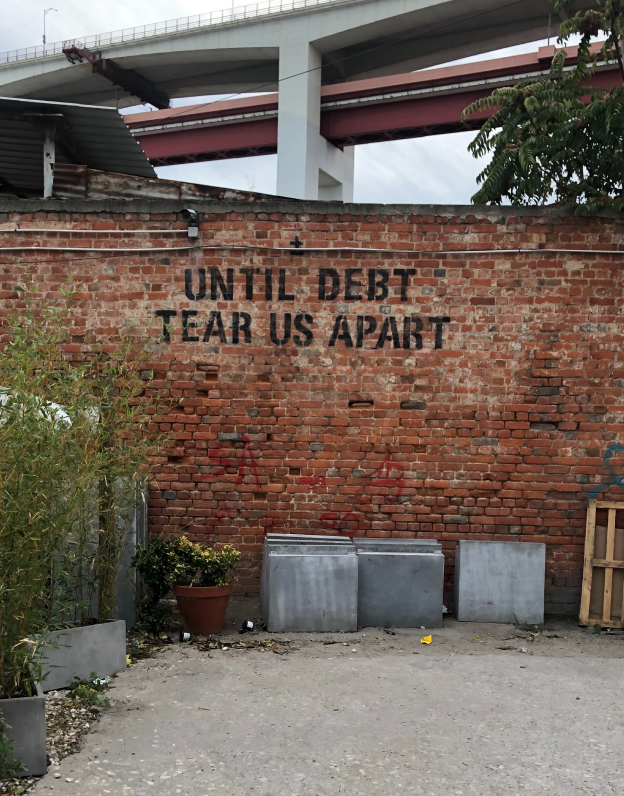

The financial industry has targeted women—who have disproportionate responsibility for caregiving, disproportionate harm from cuts to public services, and an increasing need to borrow for basic needs like healthcare—to sell them predatory lending products in a practice called “pinklining.”

In the lead-up to the 2008 financial crisis, Black women were 256% more likely than white men to receive subprime loans.

Single women have greater amounts of debt than men in every category—education debt, vehicle debt, mortgage debt, and credit card debt. And they are often targeted for toxic loans with higher interest rates or hidden fees, be they subprime home mortgages, payday lending with 400+% average interest rates, or student loans.

When they retire, the wealth gap becomes painfully clear: fewer women participate in the stock market than men and fall behind in 401k contributions. The systemic gaps in resources, opportunities, and wages have generated an extraordinary transfer of wealth from women to the financial sector. [#49]