Wall Street Established

as an Official Trading

Post of Enslaved Peoples:

1711

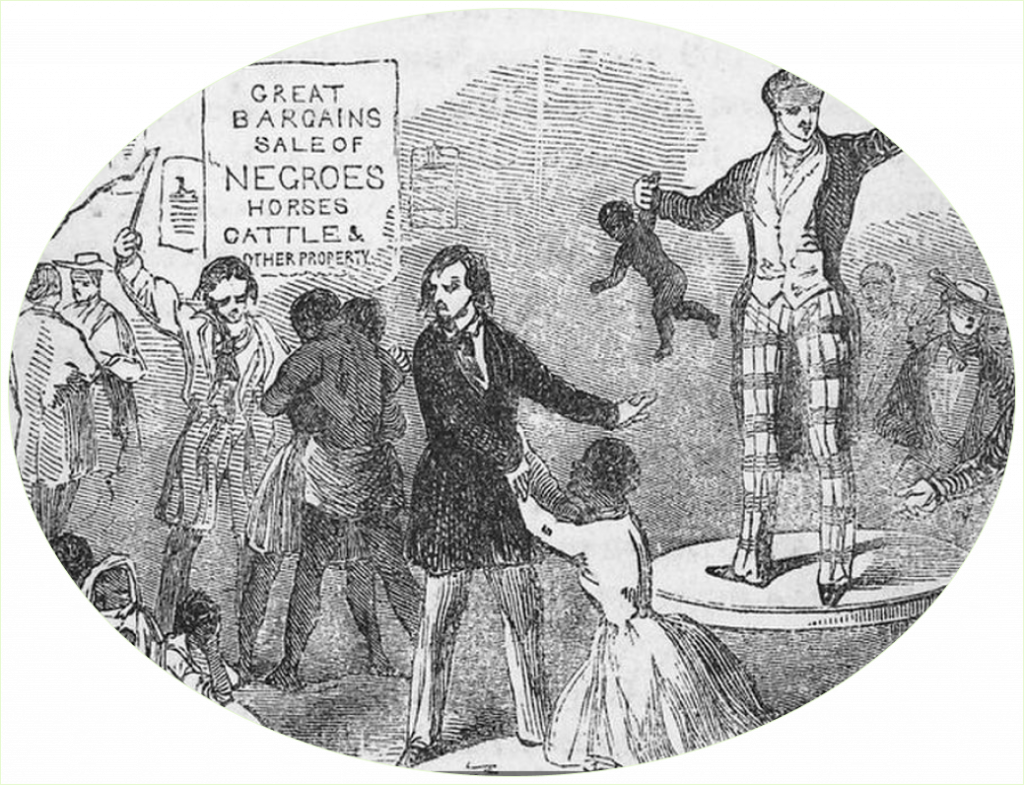

Illustration of enslaved people being sold at auction.

Less than 60 years after enslaved Africans built the wall for which Wall Street would be named, New York would erect a market at the corner of Wall and Water Streets, designating it as the city’s official slave trading post. [#05]

Later, big banks began a practice of selling “securitized slave bonds” to investors. These bonds generated revenue for Wall Street investors as enslavers made repayments of mortgages on enslaved people.

The bonds were “securitized” to pool debt from many borrowers so that the debt could be sold off in uniform chunks, reducing the risks inherent in lending to one person at a time, and in trading in human life and human productivity.

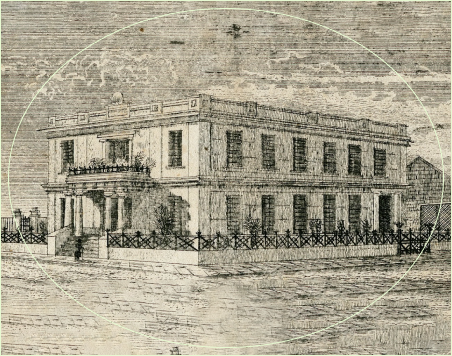

Lithograph of Canal Bank, which, with Citizens Bank, accepted approximately 13,000 enslaved people as collateral and “repossessed” roughly 1,250 enslaved human beings.

Citizens’ Bank and Canal Bank of Louisiana collectively accepted approximately 13,000 enslaved people as collateral and directly owned more than 1,200 human beings. Both are predecessor companies of what is now J.P. Morgan Chase.[#06] Wachovia Bank (owned by Wells Fargo)[#07] and Bank of America [#08] have also acknowledged profiting from ties to slavery.

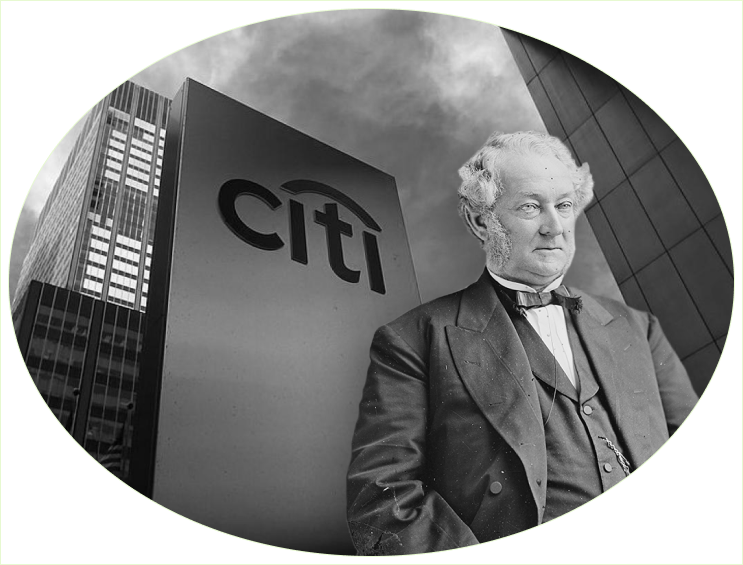

Moses Taylor, president of National City Bank of New York–now Citibank–and participant in the illegal slave trade.

At the time of his death, the estate of Moses Taylor, who served as the president of City Bank (now Citibank) for 18 years, was valued at roughly $70 million (or around $1.9 billion in today’s dollars). [#09] He remains one of the richest Americans of all time, thanks in large part to his illegal financing of the slave trade.

The New York Stock Exchange emerged from the Buttonwood Agreement. The agreement, signed by 24 wealthy white traders to regulate their exchanges, covered transactions related to the slave trade, from insurance and shipping to cotton.

The selling of human beings was by no means the only way the city benefited from the cotton trade, however. Ultimately, 40 cents from every cotton-generated dollar went to New York City to pay for the financing, transportation, and insurance of enslaved people and the cotton and other products they produced. These revenues were essential in making New York the financial and commercial center it is today. [#10]

Nearly 10 million homeowners lost their homes to foreclosure sales in the U.S. between 2006 and 2014.

The bundling of a good (in this case, human lives) into a financial product for large banks like Baring Brothers & Co. (later bought by ING) to sell was remarkably similar to the securitized bonds, backed by mortgages on US homes, that led to the economic collapse of 2008.